For many, the area of personal finance remains a mystery. Financial success seems elusive and nearly unattainable. Others think that things are fine in their world, that they’ll be one of the winners, beating the system. Yet the numbers that were true more than thirty five years ago when I secured my first licenses in the financial services world remain unchanged.

For many, the area of personal finance remains a mystery. Financial success seems elusive and nearly unattainable. Others think that things are fine in their world, that they’ll be one of the winners, beating the system. Yet the numbers that were true more than thirty five years ago when I secured my first licenses in the financial services world remain unchanged.

Out of every 100 people alive today in the United States, only one or two will become financially independent. Five or six more, with modest adjustments to their lifestyles, will be able to meet their needs for their allotted time, assuming no major economic upheavals. For the rest, their golden years are altogether different than what they had hoped for and dreamed about when they were young. Unfortunately these numbers, which have their root in reports generated by the Social Security Administration and the Bureau of Labor Statistics, apply equally to both Christians and non-Christians.

So, what are we to do? How can we gain the understandings and insights needed and apply them effectively so that we can be assured not to be among the 92 to 94 percent? How can we lead ourselves and our families to different, better outcomes?

So, what are we to do? How can we gain the understandings and insights needed and apply them effectively so that we can be assured not to be among the 92 to 94 percent? How can we lead ourselves and our families to different, better outcomes?

In the coming months, we will look at many of the tools, tactics and strategies that I have utilized over the years to help make a difference, one life and one family at a time. Occasionally you will find yourself nodding in agreement with me. But often you will find the thoughts and ideas shared to be contrary to “common wisdom” and the teachings of those who many view as the “Gurus of all things financial”. All I ask is that you keep an open mind.

So now, on to the beginning . . .

Please allow me to preface the core message in this posting with this observation:

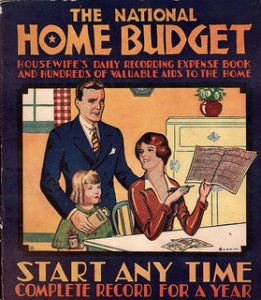

Personal finance is a team sport!

What I mean is, if you have a spouse and/or children they should be part of the process. All too often, I meet with families where only one spouse handles the family finances. This can potentially be very damaging to the relationship between a husband and a wife and it eliminates the opportunity to parent and teach our children many critical skills they’ll need later in their lives, none of which will cross their paths at school.

Before any substantive move in a more positive direction can begin, we must first understand exactly where we are now.

Before any substantive move in a more positive direction can begin, we must first understand exactly where we are now.

Click here to read the rest of the article »

Caring is sharing. Will you please share this with your network?